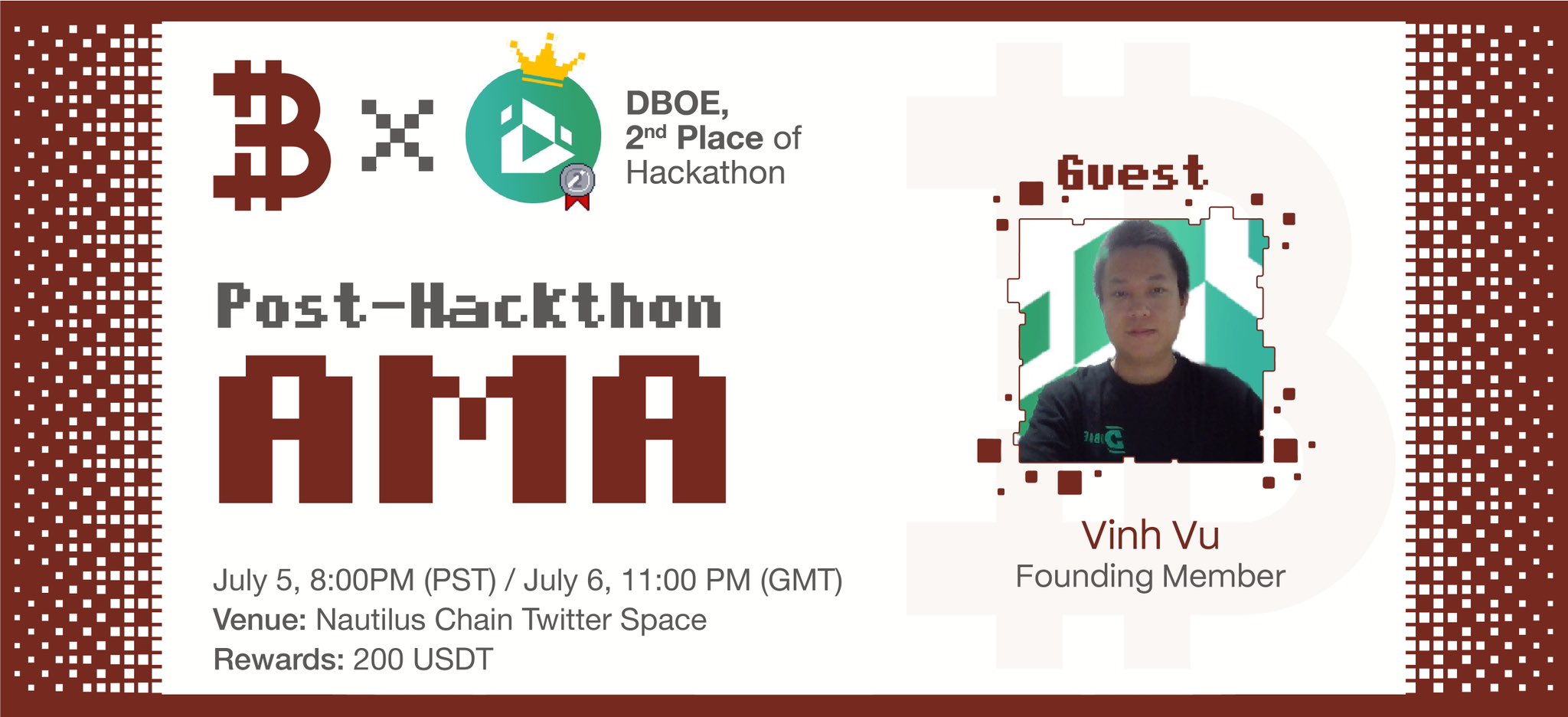

Recap: Immersive AMA with Quant Vu from DBOE – the Second Place Winner in the Boundless Hackathon @Stanford

On July 5th, 8:00 PM (PST), Nautilus Chain hosted an AMA session featuring Quant Vu, a founding member of DBOE (DeFi Board Options Exchange). Quant Vu shared valuable insights about DBOE’s innovative features and goals, making the session informative and insightful for participants. Quant Vu was invited as the guest speaker for this AMA because […]

James Harris Joins DBOE, Shaping the Future of Decentralised Options Trading

The DBOE (DeFi Board Options Exchange) proudly welcomes James Harris as an advisor, marking a significant milestone in the advancement of decentralised options trading. With an impressive background in traditional finance and cryptocurrency, Harris is poised to fortify the project’s industry connections, establish partnerships with institutions, venture capitalists, and investors, and position DBOE as a leading player in the field. […]

Introducing the Bulgarian Mathematician who Advises DBOE on the Intersection of Math, Technology, and Finance

DBOE, a prominent Option DEX initiative, is delighted to announce the appointment of distinguished mathematician Vladimir Barzov to its esteemed advisory team. Leveraging his exceptional proficiency at the convergence of mathematics, technology, and finance, Barzov assumes a pivotal role in shaping the trajectory of DBOE’s decentralised option trading platform. DBOE is an Option DEX project […]

Stay Ahead of the New Waves: Bitcoin Options Market Hits Record High, Don’t Miss Out

The Maturation of the Cryptocurrency Derivatives Market Bitcoin has recently surged within a narrow range of $27,800 and $28,300 price mark, and investors are eagerly awaiting the outcome of the Federal Open Market Committee (FOMC) meeting to see if Bitcoin’s rally will continue. Despite uncertainty surrounding the impact of the FOMC meeting on Bitcoin, it’s […]

Volatility in Crypto Options: Definition and How to Read Volatility

Definition of Volatility in Crypto Options In the context of options, volatility refers to the degree of price fluctuation or variability of the underlying asset, such as Bitcoin or Ethereum. Volatility is an important factor in options trading because it determines the likelihood of the underlying asset’s price moving up or down, which in turn […]

What makes Crypto Options so Attractive? (with detailed examples)

Crypto options trading can be profitable, but it is important to note that it involves a high degree of risk and requires a good understanding of the market and trading strategies. Options trading in general offers the potential for high returns, as options contracts allow traders to make bets on the direction of the underlying […]

European-style Options: Definition, Types and Examples

One key feature of European-style options is that they can only be exercised on the expiration date, whereas American-style options can be exercised at any time prior to expiration. This means that European-style options can provide greater certainty for traders, as the option’s value is known at expiration and cannot be exercised early. Explain European-style […]

What is Options DEX? Why do so many Crypto Investors Like Options DEX?

What is Options DEX? Options DEX, or decentralized options exchanges, have been gaining popularity in the crypto community as a secure and transparent way to trade options contracts. These exchanges operate through smart contracts, providing greater transparency and security compared to centralized options exchanges. In this article, we will explore the benefits of Options DEX […]

What is Crypto Option and the Benefits?

What is Crypto Option? Options are a type of financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (called the strike price) on or before a specific date (called the expiration date). Trading crypto options refers to the buying and selling […]

Hey Option DEX, why AMM?

The What AMM stands for “automated market maker”, a concept initiated during the development of Defi (“Decentralised Finance”) and subsequently widely deployed in DEX (“Defi Exchange”). AMM is essentially the single entity servicing an incoming order or a request for quote (RFQ) to buy or sell an asset. The price returned by the AMM upon […]