Definition of Volatility in Crypto Options

In the context of options, volatility refers to the degree of price fluctuation or variability of the underlying asset, such as Bitcoin or Ethereum. Volatility is an important factor in options trading because it determines the likelihood of the underlying asset’s price moving up or down, which in turn affects the value of the option.

In general, higher volatility leads to higher option prices because there is a greater likelihood that the option will end up in the money (i.e., the underlying asset’s price will move beyond the strike price). This is because higher volatility implies greater potential price swings, which means that there is a higher likelihood that the option will be profitable.

On the other hand, lower volatility tends to result in lower option prices because there is less likelihood that the underlying asset’s price will move beyond the strike price. This is because lower volatility implies that price movements are likely to be smaller and more predictable, which means that there is a lower likelihood that the option will be profitable.

How to Read Volatility

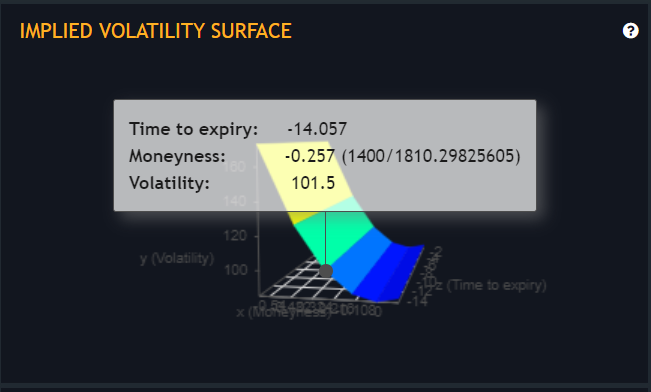

To read volatility of crypto options, traders typically use implied volatility, which is the volatility implied by the market price of the options. Implied volatility reflects the market’s expectation of future volatility and can help traders assess the risk and potential reward of trading a particular option.

Traders can also use technical analysis to read volatility of crypto options, by looking at charts and indicators that show historical volatility and patterns. Some popular technical indicators for measuring volatility include the Bollinger Bands, Keltner Channel, Donchian Channel, the Average True Range (ATR), and so on.

To see implied volatility, everyone can access DBOE Exchange and observe the “3D Implied Volatility Surface” right here: https://dboe.exchange/

Overall, understanding volatility is essential for anyone trading crypto options as it can have a significant impact on the value of the option and the profitability of the trade.