In one of DBOE’s previous articles about why investors should use DBOE, we mentioned that our platform allows the implementation of diverse trading strategies. That raises a question about some strategy. Because of that, DBOE is here to introduce one of them: Covered Put Options.

The Basics of Covered Put Options

A covered put option is a financial strategy where an investor sells a put option while holding a short position in the underlying asset. This means the investor has sold assets short, expecting the asset price to decline, and is simultaneously writing a put option on those shares to generate income from the premium received.

So, what is the mechanism of this strategy? When an investor writes a covered put, they receive a premium upfront for selling the right to sell the underlying asset at a specific price, known as the strike price. If the asset price remains above the strike price, the put option will expire worthless, allowing the investor to keep the received premium as profit.

For example, before August 4, 2024, you expect the price of BTC to decline. Shorting the asset would be the best way to gain from that, but there is a chance that the price will now decline but increase. Because you know about covered put options, you have already bought put options beforehand. So you start selling them to gain the premiums if the price goes up and you lose on your short position.

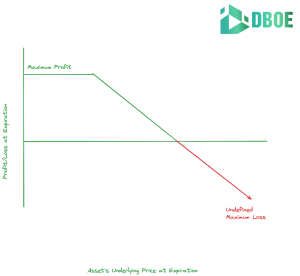

Below is a diagram that explains covered put options:

Asset Price Below Strike Price: If the asset price falls below the strike price of the sold put, the maximum profit occurs when the asset price drops to zero. The profit is calculated as the premium received plus the difference from the short sale.

Asset Price Above Strike Price: If the asset price stays above the strike price, the put option expires worthless. In this case, the profit equals the premium received for selling the put, and any losses on the short position increase as the asset price rises.

Why Do Investors Use This Strategy?

If we look at the diagram above, an investor may lose money infinitely. However, that raises the question of why anyone would use this strategy. Here are some reasons why this strategy benefits:

- Income Generation

Investors may choose covered puts primarily to generate income. By selling put options against a short position in the underlying asset, traders collect premium income, which can provide cash flow and help offset losses from the short position if the asset price rises.

- Neutral to Bearish Outlook

This strategy suits investors with a neutral to moderately bearish outlook on an asset. If an investor believes that the asset is unlikely to appreciate significantly or may experience a slight decline, selling puts can be a strategic way to profit from that perspective.

- Benefit from Time Decay

Covered put strategies allow investors to take advantage of option time decay. As the expiration date approaches, the value of sold puts may decrease if they remain out of the money, potentially leading to profits when these options are repurchased at a lower price or expire worthless.

- Mitigation of Potential Losses

In scenarios where the investor holds a significant short position, selling covered puts can help mitigate potential losses. The premium earned from the put sale can buffer against adverse movements in the underlying asset’s price, reducing overall risk exposure.

- Flexibility and Adjustability

The covered put strategy offers flexibility, as it can be adjusted or closed out before expiration. Investors can reassess their positions based on market conditions and make strategic decisions accordingly, whether it involves rolling the position or closing it to realize profits or limit losses.

Selling Put Options: A Case of DBOE

DBOE enables investors to sell put options as part of a robust trading strategy. Its unique price range feature allows sellers to pledge only the difference within the chosen range rather than the entire asset value.

For example, if a seller chooses to short BTC put options with a price range of $62,000 to $58,000 on DBOE (where $62,000 is the target price and $58,000 is the strike price), their maximum loss is capped at the spread between these two prices—$4,000 per BTC option—instead of the total value of 1 BTC.

Specifically, we allow traders to sell put options at a low price, starting at $0.5. This capability is particularly advantageous in the covered put strategy, where investors can short assets while simultaneously selling put options to generate income. By using this combination, traders aim to amplify their returns while potentially lowering their breakeven points on the underlying short position, thus improving overall profit potential in a bearish market.

Conclusion

Ultimately, during a bearish market, a covered put options strategy becomes the key to capturing the opportunity for many investors. It can benefit investors when the market goes as speculated but protect them when things go sideways. The caveat is that few platforms allow the freedom to trade put options to carry out the covered put options strategy. Fortunately, DBOE rises up as the solution for investors who are looking to diversify their investment strategy.

——————————————————————————–

At DBOE, we provide comprehensive resources and support to help you navigate the complexities of options trading. We aim to make options trading more secure and accessible.

Start your options trading journey with DBOE today at: Website or Mobile app.

Disclaimer: The information in this article is not intended as investment advice. Cryptocurrency investment activities are not legally recognized or protected in some countries. Cryptocurrencies always involve financial risks.