Cryptocurrencies, including Bitcoin, have made significant progress since their emergence a decade ago. As they gain prominence in the financial world, it’s crucial to identify the factors that can drive widespread adoption and propel cryptocurrencies to the next level of growth. In this article, we explore three essential conditions that can pave the way for true mass adoption.

1. Greater Adoption from Institutional Investors

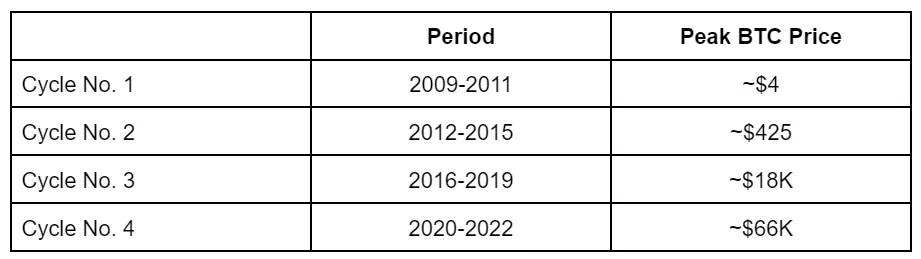

A diverse mix of clients is the ultimate milestone for any streamlined asset including cryptocurrency is no exception. Over the past decade, the crypto space has gone through four distinct boom-and-bust cycles. It is safe to attribute the first three cycles primarily to the participation of retail investors, while the last cycle saw higher participation from big clients such as family offices, corporates and crypto-related firms. It is estimated that there are approximately 500 million crypto users, which accounts for around 20% of the global working population, marking a significant milestone. The upcoming fifth cycle is expected to be driven by the institutional investors, the higher end in the value chain, who play a crucial role in the evolution of cryptocurrencies.

Since 2017, a few global exchanges in the US have started offering trading and investing of Crypto in a regulated environment starting with CME (Chicago Mercantile Exchange) and CBOE (Chicago Board Options Exchange), beginning with Bitcoin Futures. There are more exchanges, small and big in different parts of the world (Europe and Asia) have also entered the market since then. These regulated exchanges gradually enriched their offerings by expanding the underlying assets for Futures products or introducing Options as a new derivative product format. In the asset management sector, successful initiatives during the fourth cycle included the launch of Futures Bitcoin ETF by companies like Grayscale or ProShares, which attracted a significant asset under management (AUM).

After facing regulatory scrutiny and enduring a period known as the “Crypto winter” in the fourth cycle, the Crypto market is now experiencing a shift towards increased institutional participation in 2023. BlackRock, a major global fund, has applied to launch a Spot Bitcoin Exchange-Traded Fund (ETF), and WisdomTree has also filed an application for permission to launch a Spot Bitcoin ETF. These ETF products, backed by actual Bitcoin holdings, differ from existing offerings that rely on Bitcoin Futures. Despite ongoing legal disputes between regulatory bodies and cryptocurrency exchanges, these positive developments indicate a potential breakthrough for the cryptocurrency market as a whole.

2. A Supportive Regulatory Environment Somewhere

It is probably not practical to expect supportive and friendly regulation all over the world, but as long as there are some countries embracing Blockchain or Crypto then that should be a sufficient testbed for Blockchain and Crypto to showcase its full potential.

Notably, there exists a number of countries with a wholehearted support for Crypto and Blockchain such as Singapore, Japan, Dubai, European Union (EU) and of course El Salvador with Bitcoin being their legal tender. In 2019, the Monetary Authority of Singapore (MAS) introduced the Payment Services Act (PSA), a regulatory framework that oversees digital payment tokens, including cryptocurrencies and hence created a supportive environment for cryptocurrency adoption. In May 2023, MAS consulted the market for Proposed Amendments to its Payment Services Act back in 2019. This initiative signifies MAS’s commitment to continually refine and adapt the regulatory framework to keep pace with the evolving nature of cryptocurrencies.

In addition to Singapore, the European Union (EU) has also made significant strides in cryptocurrency regulation. In early 2023, EU lawmakers approved the world’s first comprehensive crypto regulation. This regulation harmonises cryptocurrency regulations across EU member states, providing legal clarity and addressing associated risks. Key provisions of the regulation include licensing and authorization requirements for crypto asset service providers, stricter rules on anti-money laundering and counter-terrorism financing, and enhanced investor protection measures. The EU’s proactive approach to regulation sets a precedent for other jurisdictions and contributes to the establishment of a supportive global regulatory framework.

Most recently, the National Tax Agency of Japan is planning to relax the tax obligation related to unrealized gains for crypto asset issuers in the country. Under the current rule, if a company holds cryptocurrencies, it will be taxed on unrealized gains, a practice that has proven costly for many firms operating in Japan. With the upcoming change, the inclusion of the valuation of self-issued digital currency by a firm operating in Japan in its market valuation has also been ruled on. This would definitely make it easier for cryptocurrency-related companies to do business in Japan.

These examples highlight the commitment of certain countries to nurture and regulate cryptocurrencies, paving the way for broader acceptance and growth.

3. A comprehensive Risk Management Tools

Last but not least, the maturation of any asset class necessitates the availability of robust risk management tools. Most intuitively, institutional investors need comprehensive risk management tools with sufficient liquidity to carry on tactical hedging before they could comfortably invest in the underlying assets. In the most fundamental form, risk management tools are in the form of Futures and Options products.

Crypto Futures trading has high trading value but is dominated by non-traditional and centralized exchanges (CEXs), leading institutions to seek alternatives. Decentralized exchanges (DEXs) have limitations in product design, risk management, and technical capabilities, lacking institution-grade standards.

Options trading in the cryptocurrency market is still underdeveloped, constituting a small fraction of the total trading volume. The introduction of reliable and regulated Options platforms, like the one offered by the CME, with sufficient liquidity can potentially address market demand and hopefully provide institutional investors with the necessary risk management tools.

In conclusion, achieving widespread adoption and unlocking the next phase of growth for cryptocurrencies requires meeting three critical conditions. Firstly, engaging large institutional investors and gaining their trust can influence regulatory policies in favour of cryptocurrencies. Secondly, the development of robust risk management tools, including Futures and Options, caters to institutional investors’ needs. Lastly, a supportive regulatory framework that balances consumer protection and innovation fosters confidence and stability in the cryptocurrency market. It’s important to note that the cryptocurrency landscape is constantly evolving, and factors like technological advancements, geopolitical influences, and market sentiment can significantly impact its future trajectory. Continuous monitoring and assessment of the latest developments are crucial in this dynamic industry.

Author: Lily Pham

Core Team Member of Defi Board Options Exchange (DBOE)