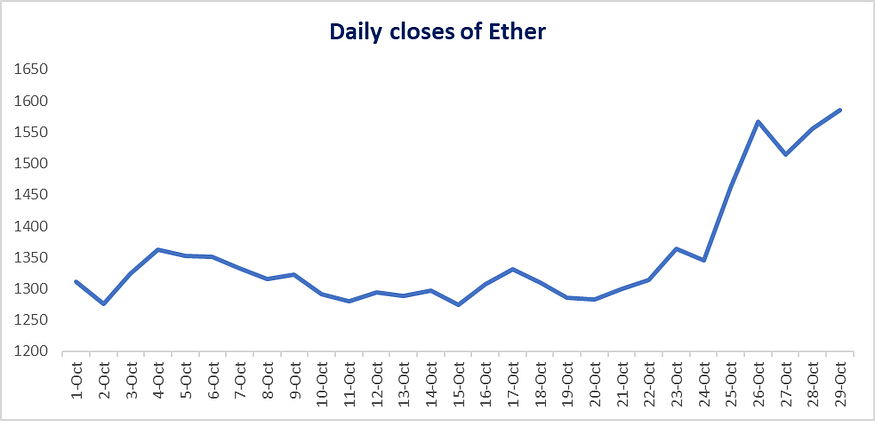

Past couple of weeks were particularly interesting for Options guys (and or girls) when market sentiment had a flip from being “reliably” bearish to bullish(ish) in a short span of time.

During the month of Oct, Ether had a moment dipped into the low of $1,274 in the middle of the month but surprisingly reversed course and climbed to $1,585 (+24% gain from the low) in a strong manner toward the month-end.

Source: Yahoo Finance

In the Option space during the same period, volatility had been reliably low (just under 50 percent point) for the first half of Oct, but jumped up more than 10 vol. points and caused pleasant surprises to those who bought volatility, but of course equally caused quite a pain to those on the other side (aka short volatility)

Selling volatility or Buying volatility?

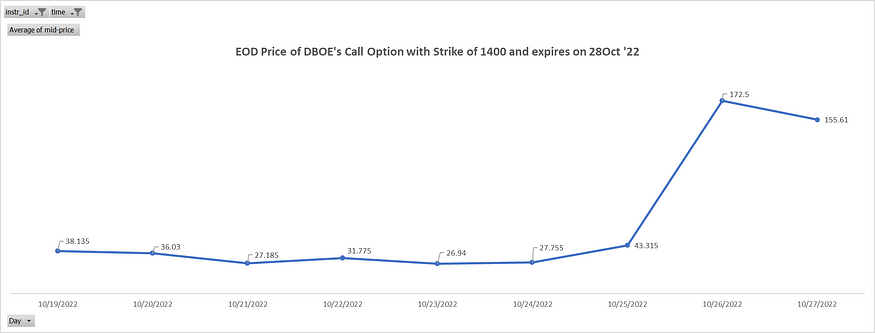

Look at one particular DBOE’s Call Option on strike price of 1400 (with target price of 1700) below

Source: DBOE Exchange (www.dboe.exchange)

This particular Option was priced just over $38 on 19 Oct and presented to the Option writers a decent P&L of 27% as of 24 Oct primarily attributable to the time decay since nothing much happened in the underlying market. 1–0 for selling Option (Selling won!)

But (the big BUT) things changed drastically since then when Ether shot up to closed to $1,570 in the next morning and drove this Option to over $43 and eventually $173 after two days. It gave back a little bit toward the expiry on 28 Oct and was final-settled around $156. Buyer of this Option on 19 Oct would make a whopping return of 310%! (Buying won!)

DBOE Options give peace to Option writers

With regular Options, Option writers carry a huge risk which could be unlimited especially when selling Call options. However, with DBOE Options, Options writers could have peace in mind (and sleep better at night) when knowing that their downside risk is capped due to DBOE’s novel (and simple) product design. Worst case is that they could be losing their collateral collected by the clearing house’s smart contract when the trade is matched and cleared. Refer to its specification at the bottom to understand why.

Apparently, winning or losing is just relative since Option might only represent half of the picture. Option seller might make money in their futures leg and similarly Option buyer might loose on their portfolio in the Ether underlying market (buyer was hedging). However, Option is clearly presenting a very appealing risk management story.

Don’t want to miss the train?

Now, let’s look at an even more long shot Call option, strike price of 1600 (target price of 1900) on the same expiry.

Given the underlying market was around $1300, this Option was having a low delta (meaning a low chance of it being settled worthy). However, it represents a truly appealing use case for investors who are in two minds, on one hand they yet have a conviction of Ether but on the other hand they do not definitely want to “miss the train” if Ether keeps going up.

Source: DBOE Exchange (dboe.exchange)

With the right timing, investors could buy this Option at slightly over $2 per contract (cost less than one cup of Starbucks coffee!). Once they have this “cheap” ticket, they could either enjoy the ride when Ether price went up (a potential exit price of $32 or 1500% return) or keep rolling the option when it expires to extend their “right” on the upside of Ether if 15x return is still small and not in their interest.

DBOE Option Specifications

Every DBOE Option (Call or Put) has a built-in hedging leg which is another Option of the same kind with further strike i.e. higher strike for Call and lower strike for Put. Visit DBOE Exchange at www.dboe.exchange for more information.