History of formation

The crypto market is a dynamic realm of volatility and opportunity, attracting investors seeking substantial gains. Within this landscape, derivatives options have emerged as powerful instruments, revolutionising risk management and market stability. Join us as we delve into the historical origins and evolutionary journey of derivatives options, exploring their impact on the crypto market.

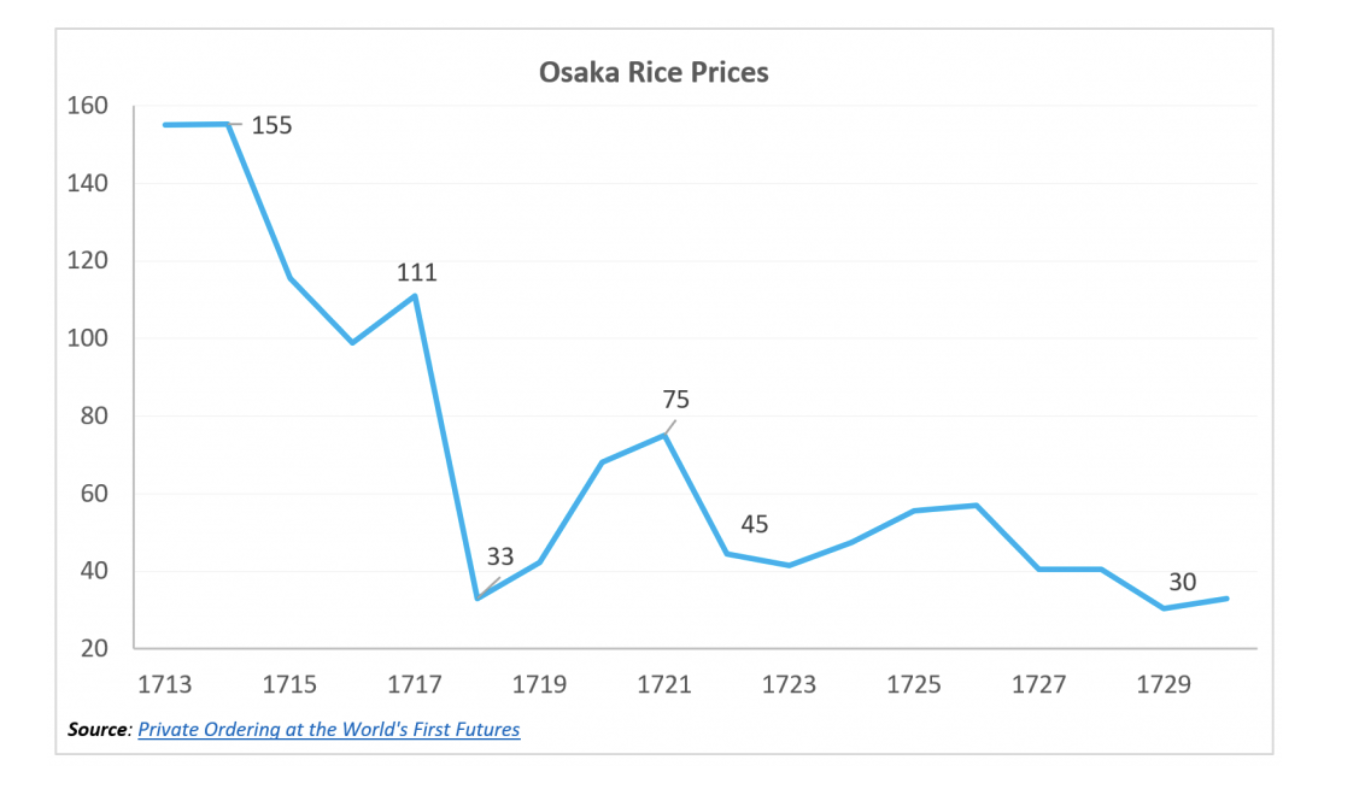

Centuries ago, forward contracts paved the way for derivatives options. In the 17th century, merchants in Osaka, Japan, pioneered forward contracts as early derivatives instruments. These contracts allowed buyers and sellers to secure commitments for future delivery at predetermined prices, serving as precursors to modern derivatives options.

Derivatives options serve as essential tools for risk management experts. While speculation is a possibility, their primary function lies in managing risks associated with price fluctuations. The Dojima Rice Exchange, an 18th-century Japanese establishment, demonstrated how derivatives played a pivotal role in managing risks during a period of rapid economic modernization. Their emergence facilitated economic growth and stability.

The Chicago Board of Trade (CBOT) marked a significant milestone in the evolution of derivatives options. Founded in the 19th century, the CBOT addressed the challenges faced by American merchants. Despite upfront expenses, they remained vulnerable to significant price risks. To protect themselves, these merchants flocked to Chicago, signing contracts to supply future grains at market prices. This marked the rapid growth and development of futures and options contracts, paving the way for their widespread adoption.

The stories of Chicago and Dojima showcase how derivative instruments fulfil the need for economic growth and acceleration during significant economic and societal changes, with a powerful and dynamic impact.

The Evolution of Derivatives Options

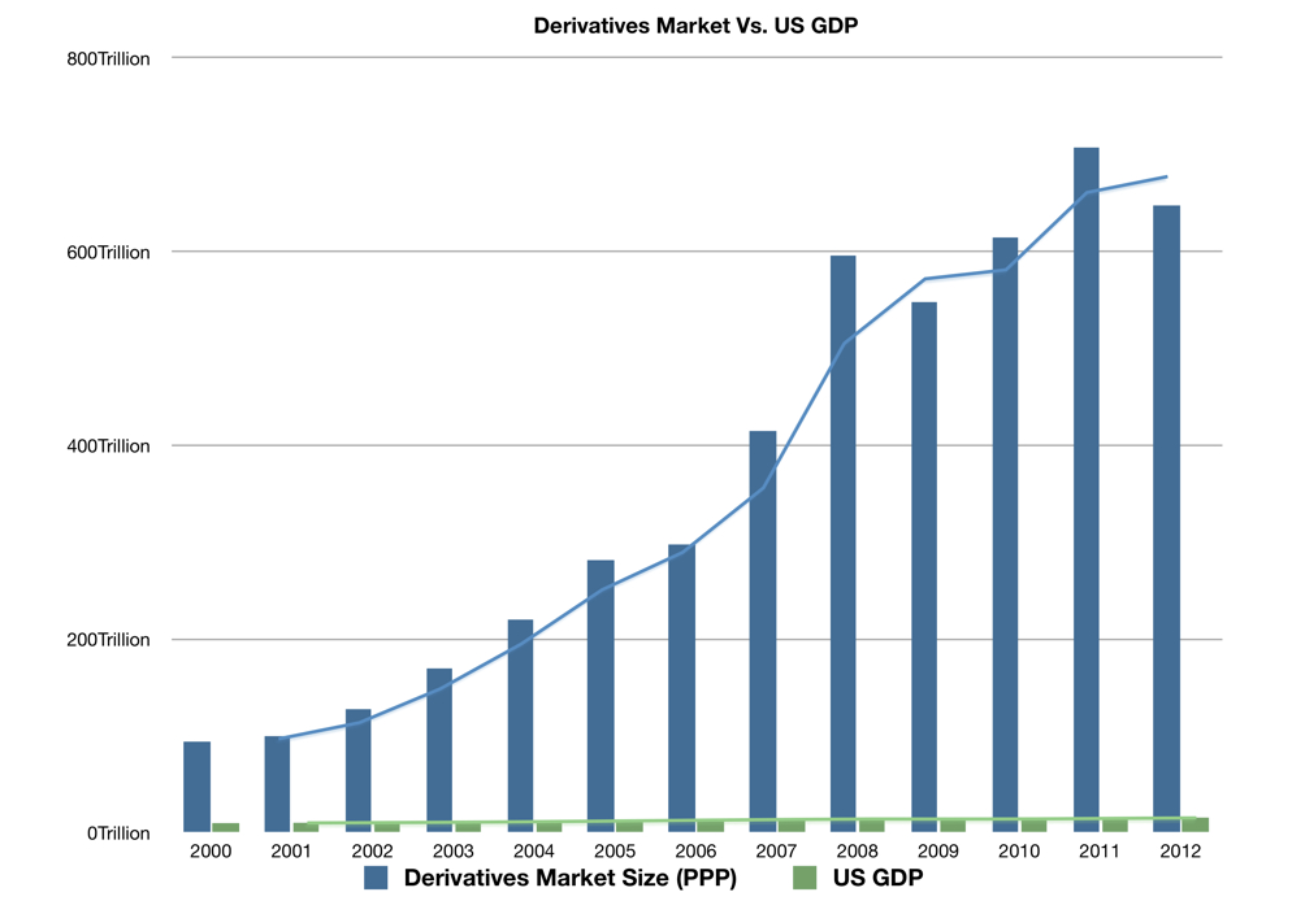

A comparative analysis of the derivatives market’s size relative to the US GDP from 2000 to 2012 reveals an astounding ascent. Starting at over $100 trillion in 2000, the market surged to surpass $600 trillion by 2012. This exponential growth is a testament to the immense potential of derivatives options, far surpassing the GDP of the United States, the world’s leading economic powerhouse.

The derivatives market, as estimated by Investopedia in an article in June 2022, exceeded a staggering $1 quadrillion. This astronomical figure underscores the colossal scale and significance of derivatives options in the global financial ecosystem.

What makes this possible?

The remarkable growth of the derivatives market can be attributed to several key factors. First and foremost, derivatives are incredibly versatile, available across a wide range of investment assets. Whether it’s equities, commodities, bonds, or currency, derivatives offer a flexible platform for investors to engage in various markets. This inclusivity has allowed the derivatives market to expand its reach and cater to diverse investment strategies.

In fact, some market analysts estimate that the derivatives market is worth more than ten times the total global GDP. This staggering figure underscores the magnitude of this market and its profound impact on the global economy. The substantial size of the derivatives market reflects the confidence and trust placed in these instruments by investors worldwide.

While futures contracts present enticing opportunities, they also come with inherent risks. Options contracts, on the other hand, have emerged as a favoured tool for investors seeking portfolio protection. By providing a means to insure their assets, options empower investors to mitigate risks and safeguard their investments against adverse market conditions. This ability to manage and minimise risk has made options contracts a valuable choice for prudent investors.

Moreover, options play a crucial role in stabilising the financial market by allowing participants to predict future price movements. By providing insights into potential price points, options enable market participants to make informed decisions, contribute to price discovery, and enhance overall market stability. The ability to anticipate and respond to market fluctuations helps create a more balanced and resilient financial ecosystem.

Let’s explore a practical example that demonstrates the value of options in protecting an investment portfolio.

Assume the current spot price of ETH is $1,000, and Lily, an astute investor, anticipates that ETH will fluctuate +-20% over the next week.

Instead of investing $1,000 to purchase one ETH outright, Lily decides to leverage options contracts to safeguard her investment. On Friday, she purchases an ETH Call options contract, which grants her the right to buy ETH at a predetermined price. This type of options contract requires an initial payment known as the options premium, typically around 5% of the total value. In this case, Lily pays $50 as the options premium.

Now, let’s fast forward to the expiration date of the options contract. There are two scenarios to consider:

- If the price of ETH increases to $1200:

In this scenario, Lily’s options contract becomes valuable. She can exercise her right to buy ETH at the predetermined price, which is lower than the market price. By doing so, Lily can sell the acquired ETH at the market price of $1200, earning a profit of $200 ($1200 – $1000). After subtracting the initial options premium of $50, Lily’s net profit is $150. This translates to a remarkable 300% return on her initial investment.

- If the price of ETH falls to $800:

In this case, Lily’s options contract would not be exercised as it would not be beneficial. However, Lily’s loss is limited to the options premium of $50. Without the options contract, if Lily had invested $1000 directly in ETH, she would have suffered a loss of $200 ($1000 – $800). By utilizing options, Lily manages to limit her loss to a mere 5% of her initial capital, providing significant downside protection.

It’s worth noting that Lily has the flexibility to either sell her acquired options at a profit or hold them until the exercise date, depending on her investment strategy and market conditions. This example showcases how options allow for a smaller initial investment while providing ample opportunities and additional time to reap substantial rewards.

By employing options contracts, investors like Lily can effectively manage risk, protect their portfolios, and potentially capitalize on favorable market movements. This practical illustration underscores the significance of options as a valuable tool for investors seeking to optimize their returns and navigate the dynamic world of financial markets.

Options: A Global Necessity and a New Trend in the Financial Industry

In 2021, the volume of options trading is projected to reach an impressive $33.31 billion, surpassing futures trading by $4.03 billion. This substantial growth is evident when comparing it to the total volume of options traded in 2013, which has risen approximately 350%. On an average trading day in 2021, the market witnessed the exchange of around 39 million options contracts, representing a notable 35% increase from the previous year.

The cryptocurrency market stands out as one of the most lubrative sectors for both individual investors and major hedge funds.

Each year, tens of millions of new investors enter the cryptocurrency space, contributing to its extraordinary rapid growth. Due to its inherent volatility, the trading range in cryptocurrencies can fluctuate 8-15 times more than in traditional markets. This heightened volatility presents a promising landscape for derivatives traders, as their profits are driven by volatility rather than just prices. It represents a golden opportunity for financial investors seeking substantial returns.

Options not only offer protection to investors but also play a vital role in enhancing market stability by providing reliable insights into future prices. This is particularly crucial in the bitcoin market, which often faces challenges related to price predictability. Options serve as a valuable tool for mitigating catastrophic price falls and managing the volatility associated with cryptocurrencies. Option traders rely on market volatility indicators as crucial decision-making factors, focusing on the overall market sentiment rather than just pricing.

Prominent financial experts, including Goldman Sachs, have voiced their predictions and announced that the options market will play a pivotal role in the next major development in the crypto space. This endorsement further reinforces the growing importance and potential of options in the ever-evolving world of cryptocurrencies.

As the global financial landscape continues to evolve, options have emerged as an essential component, catering to the needs of investors worldwide. With their ability to protect portfolios, provide stability, and capitalize on market movements, options have become a powerful tool for navigating the dynamic nature of the financial industry, particularly within the cryptocurrency realm.