In a historic moment, Ethereum (ETH) has surpassed Bitcoin (BTC) as the most traded coin in the options market in 2022. On Deribit, the leading cryptocurrency options exchange, the total dollar value of open Ether Options contracts reached $5.7 billion, surpassing the $4.3 billion locked in open Bitcoin Options trades. Deribit accounts for over 90% of the total options trading volume, making this shift in dominance even more significant.

The surge in Ethereum’s options trading can be attributed to investors repeatedly engaging in Call ETH Options trades. They are optimistic that the upcoming ETH merger, expected to occur in September 2022, will lead to a 90% reduction in ETH issuance rate and potentially drive the price of ETH to new all-time highs. The merger involves combining the existing Proof-of-Work (PoW) chain with the Proof-of-Stake (PoS) chain. This process will transfer the entire history of ETH to the new blockchain known as the Beacon Chain, which has been operational since 2020.

After the merger, the issuance of ETH is anticipated to decrease to around 0.6 million per year, with the same amount of 2.7 million ETH burned, resulting in a net annual burn of 2.1 million ETH or a -7% decrease in the annual ETH supply. This deflationary aspect makes ETH an attractive asset for investors. Additionally, the difficulty bomb will force ETH miners to mine other PoW coins or exit the market, adding to the speculation and interest surrounding ETH.

The soaring demand for Call Options trading for ETH has led to a decrease in the put-call ratio. Call options assist investors in hedging against bullish risks, while put options help hedge against bearish risks. Both types of options provide users with a means to protect their portfolios from significant market fluctuations.

The put-call ratio is a widely used metric to gauge the sentiment of a market. In equities, a put-call ratio of 0.7 is typically considered a starting point for assessing sentiment. A rising put-call ratio, above 0.7 or even 1, indicates that more put options are being purchased, suggesting growing bearish sentiment. Conversely, a falling put-call ratio, below 0.7 and approaching 0.5, is considered a bullish indicator, indicating more call options being bought.

Luuk Strijers, Deribit’s Chief Commercial Officer, noted that the put-call ratio is at a year low, signalling bullish momentum. The BTC put-call ratio stands at 0.5, while the ETH put-call ratio is half of that at 0.26, with the year-end expiry ratio even lower at 0.12. Strijers further highlighted that the highest ETH open interest is observed in the December expiry call option at a $3,000 strike price.

The increasing popularity of Ethereum in the options market reflects the growing confidence and interest in this digital asset. With the ETH merger on the horizon and its potential implications for supply and price, investors are actively participating in options trading to position themselves for potential gains.

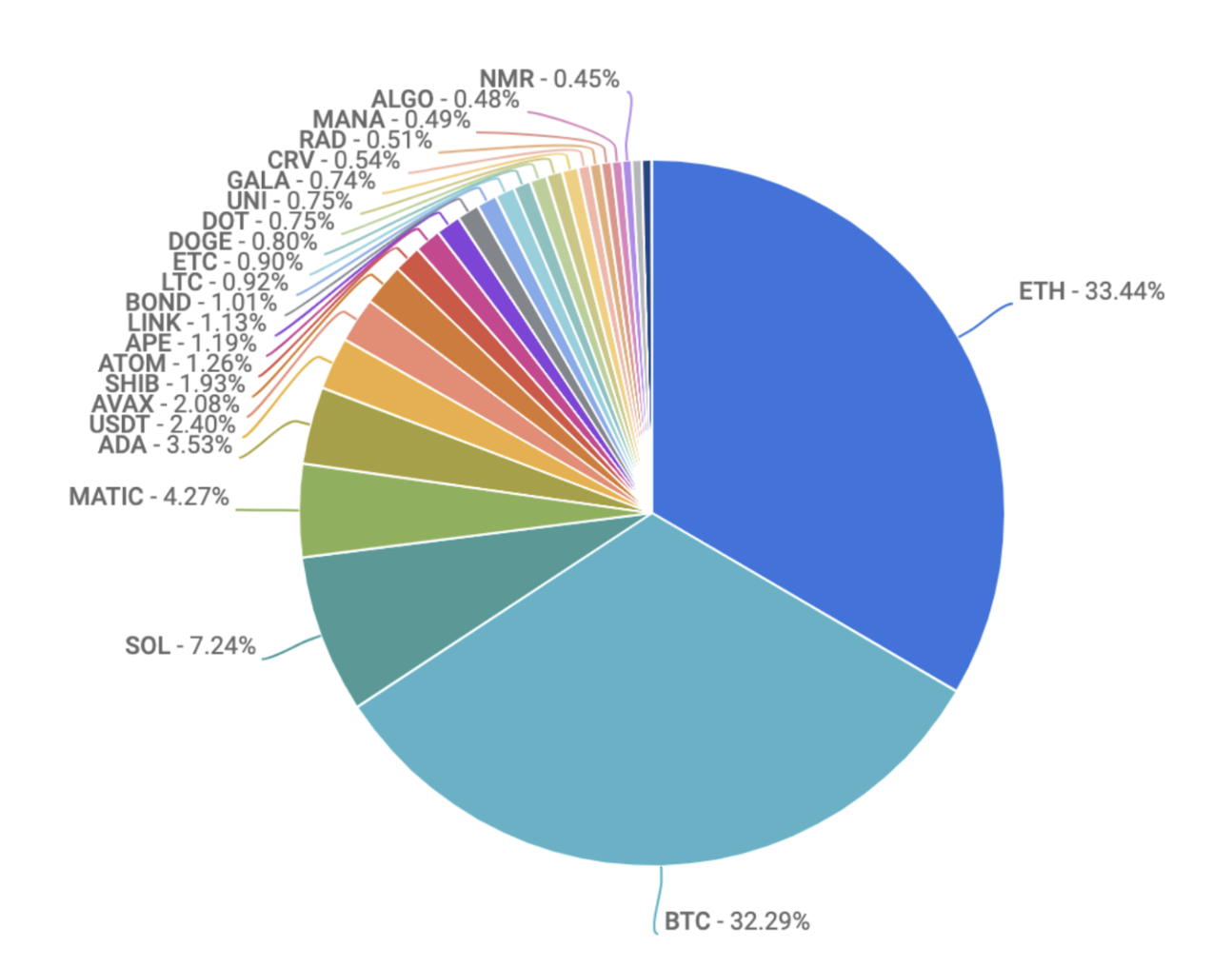

The trading volume of ETH on the Spot Market has also risen exponentially. ETH has also exceeded BTC as the most traded coin on the Nasdaq-listed cryptocurrency exchange Coinbase (COIN). For the week ending July 29, ether volume accounted for 33.4% of total asset turnover, while bitcoin volume accounted for 32%, dropping to second place.

“Investors have been looking to buy BTC because it has lagged behind ETH and the broader complex. We’ve also seen a surge in interest in SOL, MATIC, and AVAX”, according to the weekly market commentary published by Coinbase on Friday. This comment also indicated that Ether has a total market cap of $199 billion, while Bitcoin has a total market cap of $499 billion (Data recorded as of August 1, 2022). Many observers, however, believe that Ether will soon surpass Bitcoin in terms of total market capitalization and become the world’s largest coin in the future.

The Crypto Options market has only recently emerged, but it is making significant strides and catching the interest of many investors. Many financial experts believe that in the near future, this could be the third wave of the digital currency market after the previous two waves, Spot Market and Futures Market.