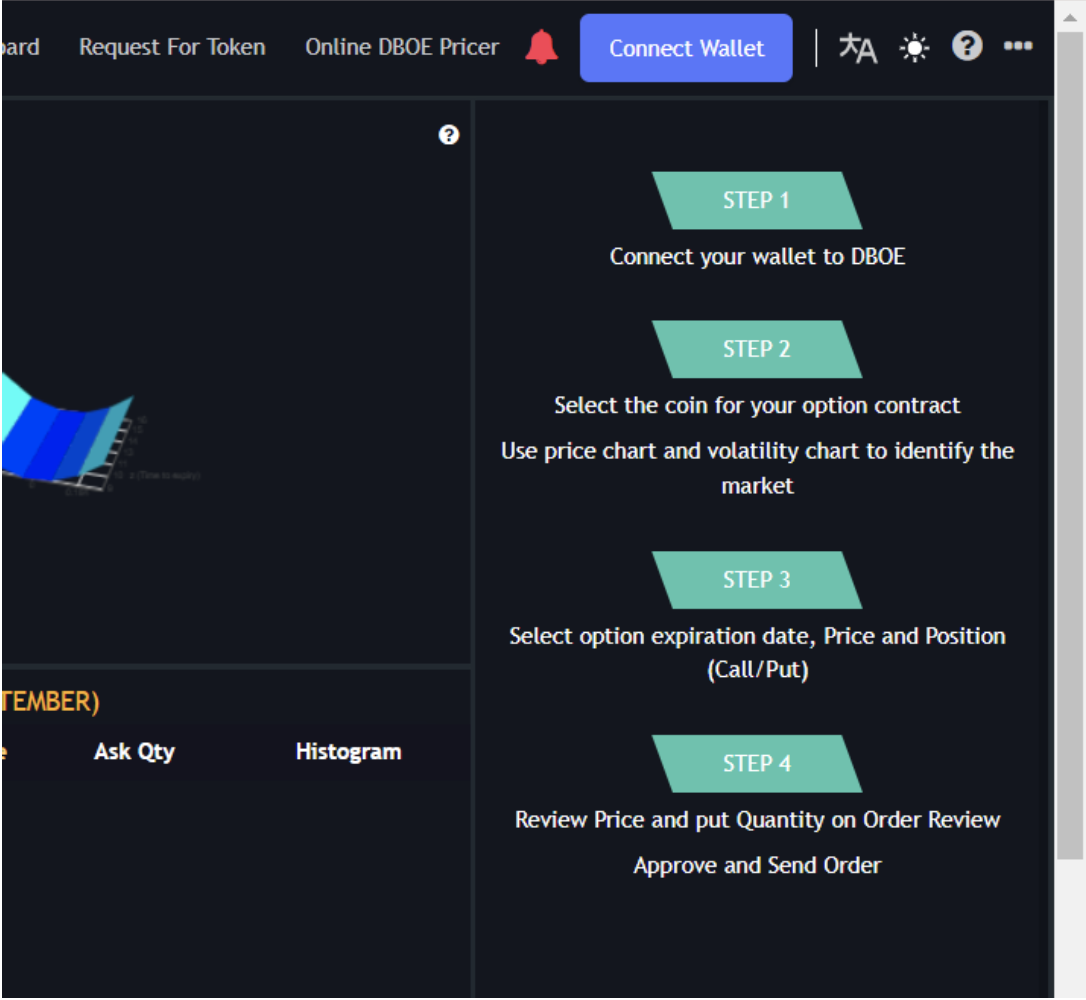

Trading Guide

Watch the video tutorial with 4 steps: https://www.youtube.com/watch?v=TmgRtAq_7_4

Step 1: Connect the Defi wallet to the exchange

Select “connect wallet” and follow the instructions

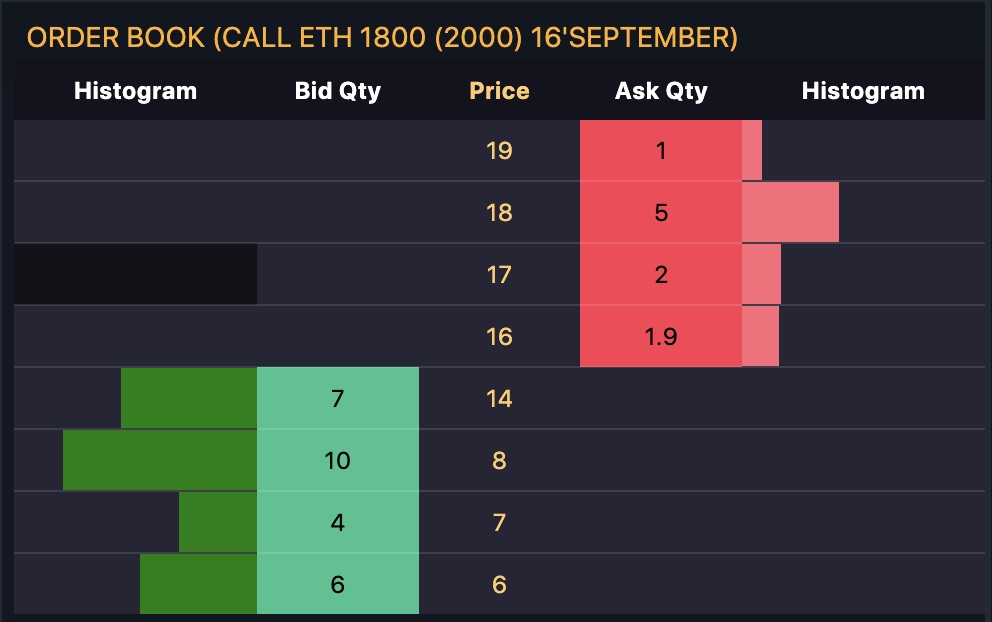

Step 2: Choose an expiration date and a price range.

Choose the expiration date and check the price ranges that interest you in the Order Chains.

In Order Book, you can see current trading volumes and option fees.

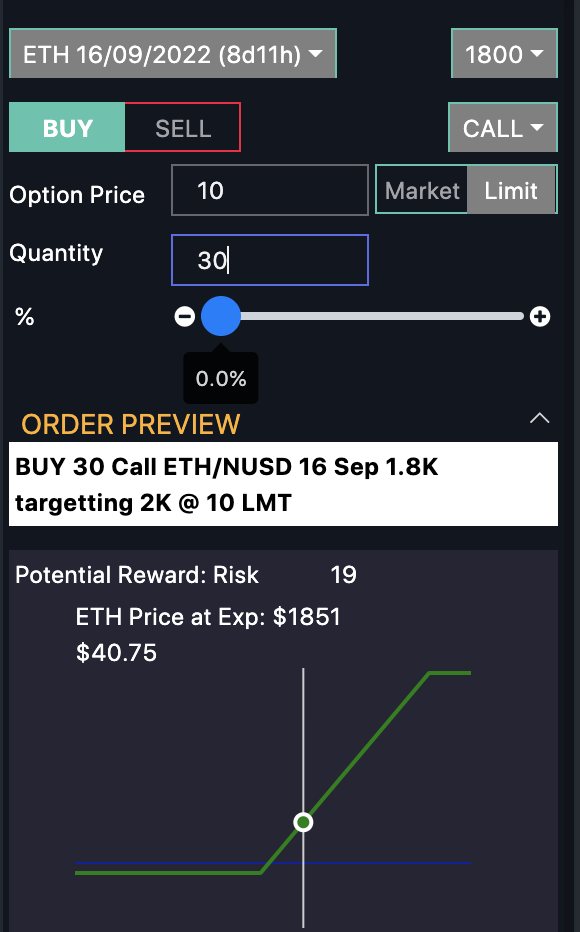

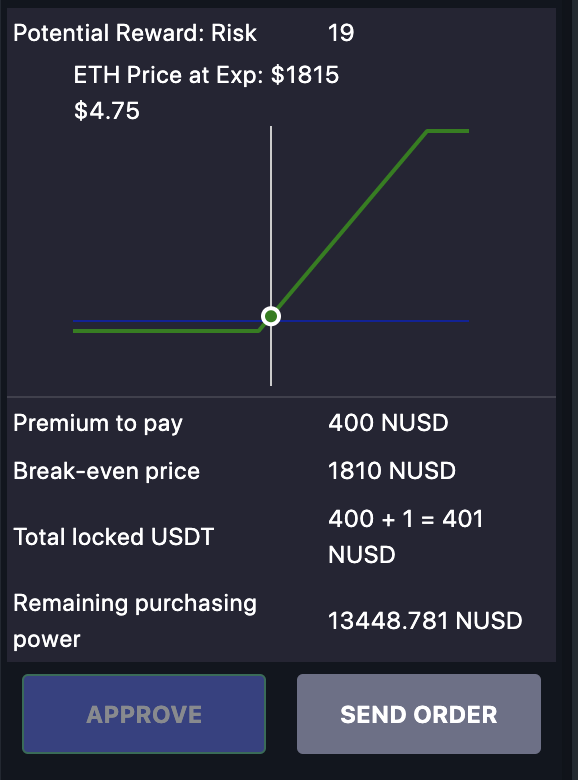

Step 3: Place an order

Select the position you want to place at the same price and volume.

PnL test expected on expiration date

Instructions for using the Black Scholes formula

Black-Scholes or Black-Scholes-Merton model is a mathematical model applied to the pricing of a number of financial products, typically European-style options. The model was put forward by Fischer Black and Myron Scholes in their 1973 paper, “The Pricing of Options and Corporate Liabilities”, published in the Journal of Political Economy.

This is a classic model based on the probabilities of market movements to give put and call options prices.

To use:

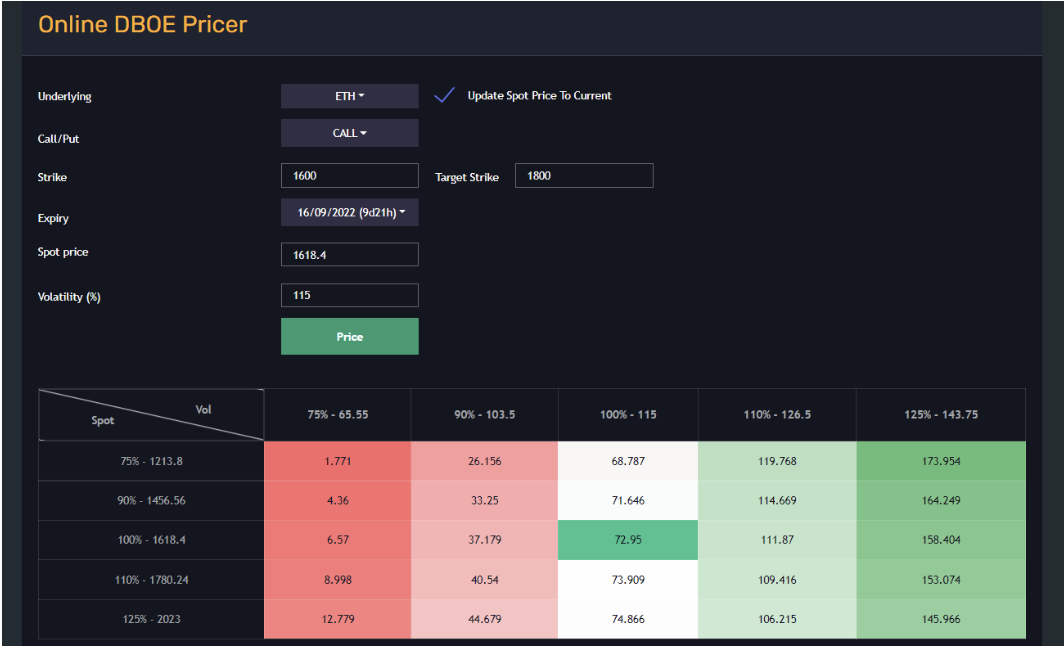

Step 1: Select the base currency and select the price range to calculate.

Selecting a Call or Put Position

Step 2: Fill in the current price of that underlying asset.

Set the level of volatility

Select prices and see the results.

Step 3: Read the result table

The resulting table shows the respective price scenarios corresponding to changes in the price and volatility of the underlying asset.

For example, the suggested price for a Call Option order is $72.95 with an expiration date of September 16, 2022.

The current ETH price is 1618.4.

The assumed volatility is 115%.

In case the price does not change but volatility increases to 10% (of 115%), i.e., 126.5, the option premium will be 111.87.

In case the price of ETH decreases by 10%, 1436 $ and the volatility decreases by 10%, the price will be $33.25.

There is a case where the ETH price is falling but volatility is changing dramatically; for example, if the price is down 10% but volatility is up 10%, the proposed option price is 114.7%.

For options investors, the most important and key indicator of option premiums is VOL volatility. Therefore, using the pricer tool is an easy way for investors to research and make decisions about placing/choosing the price/premium in accordance with their strategy.